cross-posted to DailyKos and jack and jill politics

For just over a year, I've been digging deeper and deeper into the world's energy situation and have oscillated between certainty that 90 percent of us are going to die and cautious optimism about an opportunity to improve the structure of our society.

Among the big "issues" in this political season (to the extent that we even remember those), energy, climate and food are at the top of my list.

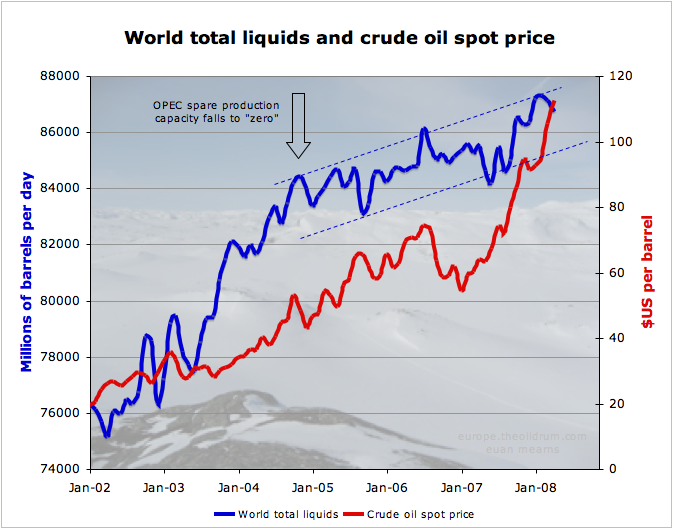

With oil prices having grown by a factor of six since 2000 and showing no sign of let up, I will increasingly post about what's going on in an attempt to share what I've learned and direct our frustration accurately and productively.

My daily must-visit site is The Oil Drum, and yesterday, they posted the single most important article explaining what's up with oil prices. The entire post is worth reading and has real perty charts and some technical detail.

I'm summarizing it below for those with less time.

1. New production is not able to offset growth in oil consumption, production declines from existing fields and the ability of oil-producing countries to tap into spare capacity

From The Oil Drum:

Every year a large number of new oil fields are brought on line. However, this does not directly translate to growth in supplies since amongst other things the production decline in existing fields needs to be replaced first: new annual production capacity = consumption growth + annual decline + spare capacity growth

The above leads to a supply vs. demand situation in which supply cannot keep up. Demand globally is growing. Many existing oil fields are past their peak production, meaning they produce less and less as it becomes more difficult to get the oil out. Finally, contrary to popular opinion, OPEC isn't simply holding out on us. They cannot turn the spigot on any higher, cause they're running at max output.

Basically, more people want milkshakes and it's harder to suck that milkshake out of the cup (h/t There Will Be Blood).

2. The new resources we're getting from natural gas, ethanol, tar sands, etc have lower energy content than the sweet sweet crude oil we're used to. One barrel of ethanol has the energy content of only 0.61 barrels of crude oil

As the easy oil has been sucked out of the ground, we've found it more economically viable to squeeze liquid fuels from other sources like biofuels and the tar sands of Canada.

Wired ran a great piece within the past few years comparing the prices necessary to generate an economic return on these unconventional sources. It basically said, "when oil reaches $x per barrel, it makes economic sense to squeeze tasty oil out of canada's rocks or squirrel farts or whatever."

What these economic return arguments miss is the energy return on energy invested (EROI). At some point, you're spending a barrel of energy to get a barrel of energy, and you're looking kinda stupid. No milkshake for you.

When you hear folks get all excited about tar sands and polar this and that, just remember how much energy it takes to get oil out of a deeper well or squeeze oil out of a rock (about the same amount of energy it takes to get an informed idea into a cable news broadcast).

3. Even if oil producing nations aren't yet producing less, they are exporting less.

As oil producing countries develop and pursue that American dream of leaving no car left behind, they use up more of their own oil. When everybody starts moving to the city and industrializing, mad oil is needed for building, road construction, plastic bottles and other benefits of modern living.

Governments in these countries often heavily subsidize the price of oil to keep their people happy. We've done an indirect version of this in America by having the government pay for roads, licensing systems and other necessary infrastructure for the car. However, countries like Russia actually subsidize the price directly at the pump, driving domestic demand even higher.

Less oil in the export market drives up the price for those of us dependent on importing oil's tasty goodness. We really really want that milkshake and are willing to do lots to get it. I'm not saying we'd generate trumped up reasons to invade a nation with big oil reserves. I'm just saying milkshakes and freedom are very very important and sometimes worth fighting for.

The rest of The Oil Drum's article explains why other explanations you've heard for oil's high price -- speculators, political instability, currency -- are not nearly as powerful a force as the basic supply and demand invisible hand currently backhanding us toward ever higher prices.

It closes:

We are now in the early stages of a full blown energy crisis that was predictable if not wholly avoidable. Politicians are awaking to the crisis now that escalating energy costs make its existence plain to see. It is highly unlikely that politicians will now grasp the gravity of the situation that the OECD and rest of the world faces and the responses will likely be ineffectual and too little too late. The principal reason for current high oil price is the proximity of a peak in global oil production. Politicians must understand this and then grasp that natural gas and coal supplies will follow oil down by mid century. Reducing taxes on energy consumption right now is the wrong thing to do. Taxation structure needs to be adjusted to oblige energy producing companies to re-invest wind fall profits in alternative energy sources on a truly massive scale. Energy efficiency should be the guiding beacon of all policy decisions and this must apply equally to energy production and energy consumption.

I will keep blogging about energy, the problems we face and the opportunities before us. I'm working on a site to aggregate some of my favorite sources. In the meantime, check out this primer on peak oil, and become a regular visitor over at The Oil Drum.

We're going to see increasingly hysterical coverage of energy over the next year, and I want to make sure folks have a source for informed coverage and analysis.